Righting the Rules for Shared Prosperity – Part 1: The Problem

Finance is a dominant driver of innovation and economic growth in the United States and abroad. However, debate remains whether finance and capitalism can be a force for good. Recent news around Opportunity Zones highlights the skepticism which insists that financial investment in marginalized communities cannot achieve positive results for both investors and the community.

At the Beeck Center, we believe that finance can deliver social and environmental outcomes in service to the common good, that it is a fundamental tool for solving intractable social problems like poverty and wealth inequality, and we are committed to using financial tools to create impact at scale.

Impact at scale means redesigning current systems, and the courage to think, behave and collaborate differently. Investing for outcomes also means shifting incentives and addressing systemic inequities to achieve lasting change. As we seek to shift systems so that they work for all stakeholders, we are embarking upon a new initiative known as Fair Finance, which aims to right the rules of the game for shared prosperity. For us, attacking these systems isn’t just a job, it’s a personal commitment driven by our life experiences.

How We Got Here

-

- Fair Finance: It’s Personal (Lisa Hall)

- When Opportunity Knocks, Open the Door (Jen Collins)

The Problem We’re Trying to Solve

All too often the policies that shape the flow of capital enable an elite group of those who are already extremely comfortable to be more comfortable. This new Beeck Center initiative envisions a world where the tools of finance are intentionally directed towards improving all of society and equalizing access to opportunity. We’ll examine and deconstruct the financial systems that perpetuate inequity and a profit-only mindset, while promoting programs and tools that harness the power of capitalism to create positive social impact.

At the Beeck Center we confront the powerful constituencies that promote and preserve the myth of opportunity or the “American Dream,” which ignores systemic and persistent barriers to financial and economic success like racism and sexism. We draw upon global examples to identify scalable solutions for the United States that address these challenges. We’ll also directly address obstacles to opportunity and market access that hinder economic growth in many U.S. communities. Over the past 35 years, prosperity has been limited to a small percentage of the U.S. population. Access and opportunity have not been evenly distributed, despite rational thinking that talent and potential are evenly distributed in rural and urban areas; among whites, African-American, Latinx, and Asian communities; between tribal lands; and across religious groups and ethnicities.

One example of growing inequity is the dramatic change in CEO compensation as compared to other employees throughout recent decades as illustrated by the above chart produced by Economic Policy Institute.

The Opportunity at Hand

Technology, social innovation, and impact investing are driving exponential change around the world, and increasingly business leaders are recognizing that long term financial sustainability is inextricably linked to social and environmental sustainability. Ideas that once seemed impossible are now within reach, enabled by the digital age and the ability to communicate and transact rapidly. Dynamic leaders like Rodney Foxworth of BALLE (Business Alliance for Local Living Economies, Stacy Abrams and others from across the private, public and non-profit sectors are making bold, audacious recommendations for change while tackling challenging economic, political and environmental realities. Increasingly, individuals are examining their lifestyles and demanding social impact in every area of their lives, including purchases, investments, and other choices.

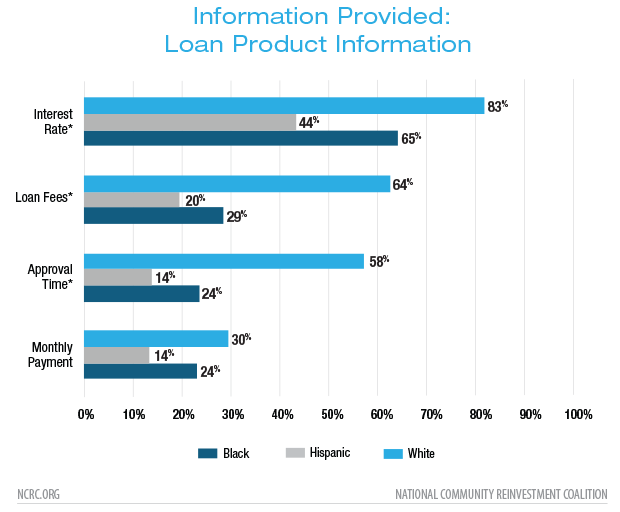

The failure of investors to tap the capacity of communities of color prevents the country from maximizing its full potential. A recent study by the National Community Reinvestment Coalition shows the barricades that minority entrepreneurs face when looking to expand their business. As reported by the Washington Post,

“The organization sent teams of white, black and Hispanic “mystery shoppers” who acted as prospective borrowers to evaluate customer service interactions with the banks’ small business lending representative at 60 Los Angeles area banks. The testers had nearly identical business profiles and strong credit histories, with black and Hispanic testers possessing slightly better incomes, assets and credit scores than their white counterparts.

In almost every measure, white testers received superior customer service, the study found. Bank representatives asked white prospective borrowers fewer questions about eligibility and provided them more information about loan products.”

When minorities talk to loan officers, they don’t always get the full picture of what’s involved, which can discourage their application. Credit NCRC

These experiences highlight the need for more capital in communities that are often underestimated and overlooked but are critical to the future economic growth of the United States.