Righting the Rules for Shared Prosperity – Part 2: Our Approach

Read Part 1: The Problem We’re Trying to Solve

Our Approach to Solving the Problem

The Beeck Center creates space and opportunity for uncomfortable conversations, while seeking and creating bold solutions. The Fair Finance Initiative is an ambitious program that aims to right the rules, both written and unwritten, currently in place for investment of capital in low-income, disenfranchised, and underserved communities.

Over the next two to three years, the Fair Finance Initiative is focusing on the following programs:

Reimagining Community Investing for the 21st Century

We are focused on a future for community and sustainable investing that is rooted in the lessons of the past, but which results in systems change driven by policies that do not simply tinker around the edges. The Beeck Center is soliciting, examining and designing policy solutions on a federal and local level to deliver positive social outcomes in communities that have been historically overlooked and underestimated by traditional investors. Potential policy recommendations include the creation and capitalization of a new form of tax-exempt community institutions, deconstruction of the U.S. Department of Housing and Urban Development, and the consolidation of programs focused on community development under a new agency. The initial stages of this work are being generously supported by Incite whose mission is to build movements by transforming big ideas into big deals.

Project Lead: Lisa Hall Funding Partner: Incite

To uncover bold new ideas we must first understand the past. This timeline, created by the Beeck Center, charts key programs and significant developments in “A History of Community Investing in the United States.” Created by Student Analyst Kriti Sapra through the Knight Lab.

Driving Impact in Opportunity Zones

The bipartisan passage of Opportunity Zones legislation has led to multi-stakeholder conversations around community investing. The Beeck Center is supporting the original intent of the legislation by driving positive social outcomes in Opportunity Zones. Since February 2018, the Beeck Center has led national efforts to incorporate impact objectives into investment strategies for Opportunity Funds. We are using the conversation swell around OZs to collaborate with investors and test new models of community investment.

Opportunity Zones are an ideal conduit for exploration of creative ideas for location-based community investing in the United States. Earlier this year, In partnership with U.S. Impact Investing Alliance, we produced the Guiding Principles and Impact Reporting Framework for Opportunity Zones in addition to creating an Opportunity Zone Investor Council. We are grateful for the generous support of the 15 Council Members, a powerful group of investors, developers and fund managers that are setting a new standard for impact.

Project Lead: Jen Collins

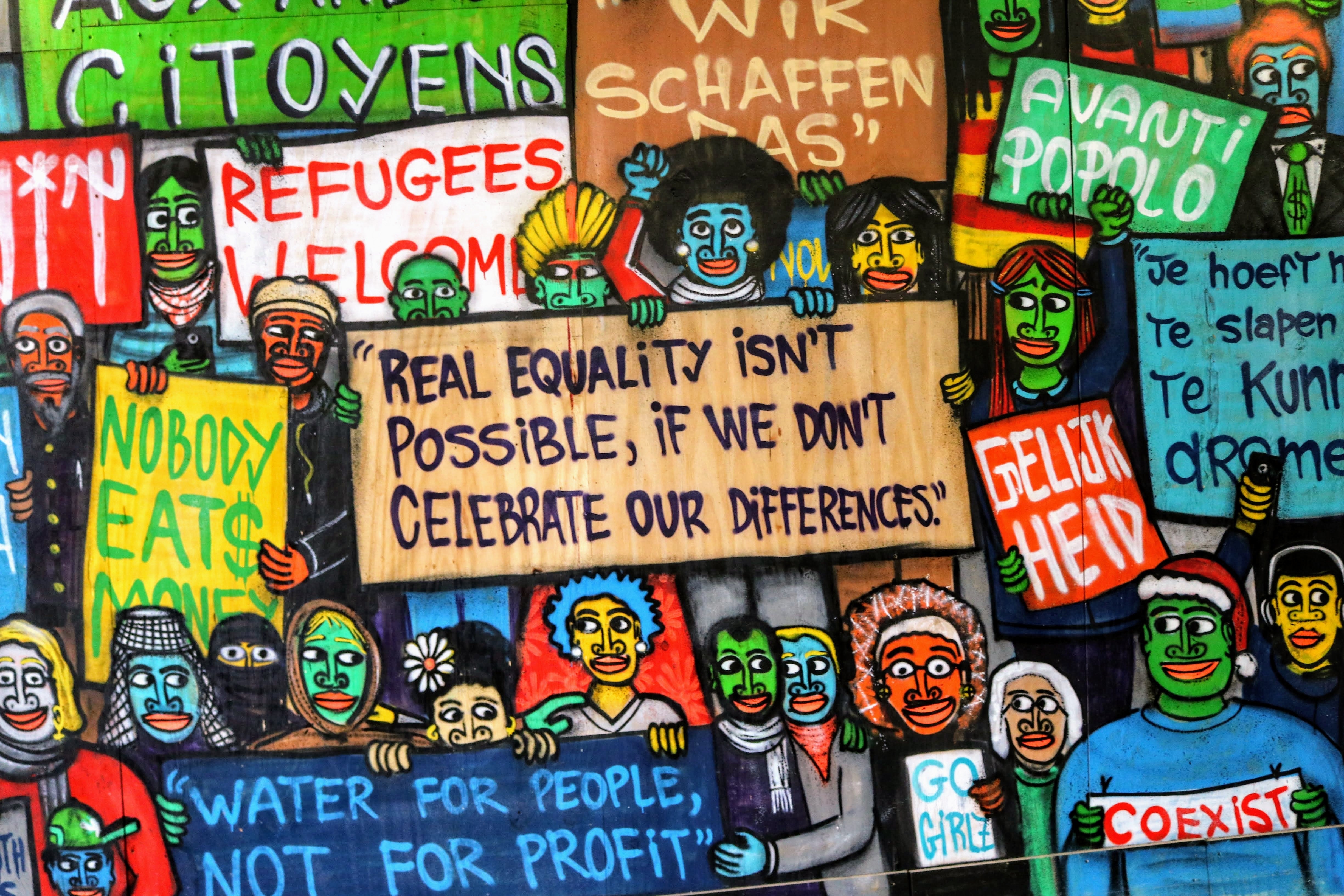

Financing Immigrant and Refugee Integration

The U.S. population is rapidly diversifying. As has been the case since the founding of the country, much of this diversity comes from immigrants and refugees—currently over 44 million people, nearly half of whom are of working age. It benefits everyone to integrate these new arrivals into society and tap their expertise, energy and earning potential.

Yet, we currently have a systemic problem. Many individuals are unemployed or under-employed, At the same time, the U.S. anticipates a shortfall of 1.9 million workers by 2024 (Bureau of Labor Statistics). Bringing immigrants and refugees into the workforce will enable them to use their skills, support their families, and contribute to the U.S. economy. This integration would represent significant impact at scale.

The Mariam Assefa Fund, a new initiative of World Education Services (WES), seeks to reduce the barriers that prevent immigrants and refugees from finding meaningful employment in the U.S. Thanks to a generous grant from WES, the Beeck Center is exploring ways to finance training and workforce development for these workers. We are reviewing the current landscape of workforce development financing, and will consider the history and applicability of other innovative financing programs that target outcomes with a social element (e.g., Pay for Performance contracting, or Loan Guarantees). We’ll engage a diverse group of stakeholders and experts including investors (both traditional and impact), policymakers, corporations, community leaders, academics (from both national universities and community colleges), and representatives from the immigrant and refugee communities, to identify the most promising (and most scalable) approaches to financing economic integration. Throughout, we will involve our students and seek collaboration with other centers and individuals at Georgetown.

Project Lead: Betsy Zeidman Funding Partner: WES – World Education Services

Promoting Inclusive Entrepreneurship

Creating prosperity for all, means including all communities in the nation’s economic growth. With the vast majority of net new jobs coming from new business startups, the people, policies and finance governing the field of entrepreneurship matters. Today, 92% of the decision makers behind the venture capital that drives most high-growth startups are men and less than 3% are investors of color. These investors provide 2.2% of that capital to female founders and only 1% to entrepreneurs of color. How we tell these stories is as important as the numbers themselves.

The world’s business news media was created more than 150 years ago. Today, even leading publications still view the world through this mindset, focusing on institutions, hierarchies and narrow, extractive views of what’s valuable. Many stories and important trends are left out when this world view is applied to journalism.

Times of Entrepreneurship is a new business publication that upends the old model. Times of Entrepreneurship highlights communities and individuals, regardless of race, place, class and gender. Its innovative reporting structure puts journalists in secondary U.S. markets, but gives them global beats in Money, Food, Climate, Security and Health, with two-cross-cutting channels, Women-Owned and Migrant-Owned Businesses. It covers innovation and trends in entrepreneurship and among leading investors. Our journalistic lens seeks different and new ways to measure value and to document the dynamic, entrepreneurial systems that shape institutions as they evolve — hopefully toward a more equitable and sustainable future.

Project Lead: Elizabeth MacBride Funding Partner: The Ewing Marion Kauffman Foundation

Photo by Adeolu Eletu on Unsplash

Creating Equitable Capital Markets

The concept of capitalism presumes perfect information and equal opportunity. The reality of capital markets is that information and opportunities are distributed unevenly. ”Free market” absolutism has left behind millions of Americans over the past 10 years and created prosperity for a small number of Americans. At the Beeck Center we create opportunities that help shrink the racial and gender wealth gaps.

Initiatives like the Racial Equity Assets Lab (REAL), and the recent study sponsored by Knight Foundation are sparking discussions around the disparity in capital allocation to fund managers of color and women-led fund managers in spite of financial performance that matches the performance of white men. We collaborate with others to identify practical solutions to addressing barriers for these fund managers, through further research in conjunction with existing ecosystem players. Potential program activities include the creation and dissemination of video content to highlight market inequities and promote solutions, like the global directory of women in venture capital. We are also conducting a landscape survey of initiatives underway to bolster the ecosystem for fund managers of color and women-led fund managers. We are grateful for the generous support of Surdna Foundation, the seed funder of this work.

Project Lead: Lisa Hall Funding Partner: Surdna Foundation

—

Through these projects, the Beeck Center contributes to the momentum of an existing flywheel for change in capital markets. We are connecting the dots between many disparate efforts around finance as a tool for prosperity including impact investing, community development finance, corporate social responsibility, and conscious capitalism. In our vision, prosperity is shared among many rather than hoarded by a few. Please join us in pushing the wealthiest nation in the world to provide equal access and a fair shot at sound economic and financial opportunity for all.